On the surface, manual payroll processing might seem manageable — especially for small teams or early-stage companies. But behind the scenes, it’s a productivity drain, a compliance risk, and a hidden cost center.

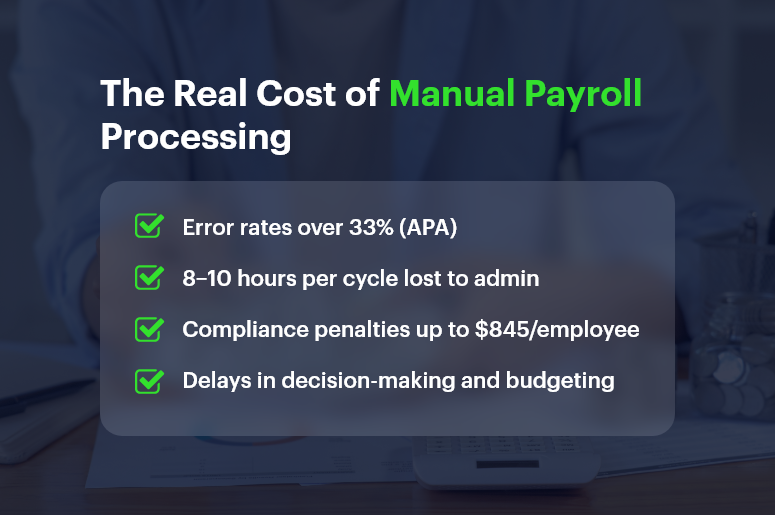

In fact, the American Payroll Association found that payroll errors affect over 33% of businesses, often costing hundreds to thousands annually per employee. And yet, many companies stick with spreadsheets and legacy systems simply because “that’s how it’s always been done.”

In this blog, we’ll explore why manual payroll processing is costing you more than you think, uncover the real-world risks, and show how platforms like CRMLeaf’s CRM + ERP help modernize payroll with automation, accuracy, and insight.

The Real Cost of Manual Payroll: Why This Matters to Growing Businesses

Manual processes aren’t just outdated — they’re dangerous in a fast-paced, compliance-heavy, and data-driven business world. And the impact isn’t limited to just HR.

1. Manual Means Mistakes — And Mistakes Cost Money

- Data entry errors are common: Manually inputting hours, deductions, and tax codes opens the door to mistakes. One wrong cell and your employees get underpaid or your business overpays taxes.

- Fixing errors eats into productive time: HR and finance teams often spend hours fixing mistakes instead of focusing on strategic initiatives.

2. Hidden Compliance Risks Are Always Lurking

- Tax laws change constantly: Staying updated manually across multiple jurisdictions increases the risk of fines and audits.

- Late filings or misclassified employees can result in government penalties, legal trouble, and loss of trust.

3. Employee Experience Takes a Hit

- Late payments or incorrect paychecks hurt morale: It’s hard to keep employees engaged if they’re constantly questioning their pay.

- Manual processes reduce transparency: Employees may not know where to go for breakdowns, deductions, or past payslips.

4. Business Scalability Slows Down

- Manual payroll doesn’t scale: The more employees you onboard, the harder it becomes to track benefits, bonuses, and time off accurately.

- Disconnected systems stall decision-making: Without real-time integration between payroll, finance, and HR, you lose visibility.

From retail and manufacturing to tech startups and agencies, businesses in every industry face these bottlenecks — until they automate.

The True Costs of Manual Payroll Processing: Let’s Break It Down

You might think manual processing saves you software costs. But here’s what it’s costing:

1. Time Cost

- Manual payroll can take 8–10 hours per cycle, depending on employee count, overtime tracking, tax calculations, and approvals.

- Multiply that across 12–52 pay periods, and you’re talking about dozens of workdays lost annually to payroll administration.

2. Financial Risk

- A simple mistake — like failing to withhold the correct tax — can cost businesses up to $845 per year per employee in penalties, according to the IRS.

- Labor audits due to noncompliance often result in thousands in legal fees.

3. Opportunity Cost

- Manual payroll drains time that could be spent on performance analysis, workforce planning, or improving employee engagement.

- Delayed payroll insights mean you can’t react quickly to budget overruns or labor costs exceeding projections.

Best Practices: How to Eliminate the Hidden Costs of Manual Payroll

It’s time to stop treating payroll like a back-office burden and start managing it as a strategic function. Here’s how to make the shift:

1. Automate Data Collection with Integrated Time Tracking

- Sync employee hours, leave records, overtime, and holidays with your payroll system using CRMLeaf’s unified CRM + ERP.

- You’ll eliminate manual errors and gain real-time visibility across departments.

2. Implement Tax Rules & Compliance Workflows

- Automate tax calculations and state-specific compliance checks within your payroll module.

- CRMLeaf keeps tax rules up to date, so you’re always audit-ready without manual intervention.

3. Generate Reports Instantly

- From payroll summaries to compliance reports, automation lets you run reports with one click instead of piecing together Excel sheets.

- This makes it easier to justify expenses, analyze labor trends, and share insights with leadership.

4. Give Employees Self-Service Access

- Empower employees with portals where they can access payslips, tax forms, and payment history — reducing HR queries by up to 40%.

- CRMLeaf includes secure, role-based access so sensitive data stays protected.

5. Sync Payroll with Project Costs

- When payroll data integrates with projects and budgets, you can track real-time labor costs per client or task.

- This is crucial for consulting firms, marketing agencies, and any business with billable hours.

Customer Story: How One Business Slashed Payroll Costs with CRMLeaf

For example, TaskPro, a logistics company with 150+ employees, was managing payroll manually using spreadsheets and a legacy HR tool.

Once they switched to CRMLeaf’s payroll automation, the impact was immediate:

- Payroll processing time dropped by 60%

- Error rate reduced by 80%

- Annual compliance fines went from $6,000 to zero

TaskPro also integrated payroll with their budgeting module — improving project profitability by understanding labor cost allocations in real-time.

Key Takeaways: Automation Isn’t Optional Anymore

Here’s the reality — manual payroll processing is draining your time, increasing risk, and limiting your growth.

To recap:

- Manual methods introduce more errors, which cost both money and employee trust.

- You’re losing valuable time and missing out on insights that modern automation delivers instantly.

- Payroll should be part of your business intelligence strategy, not just a monthly task.

With CRMLeaf’s CRM + ERP platform, payroll is integrated, automated, and optimized — so your teams can focus on strategy, not spreadsheets.