Picture this: one small fraudulent expense — say, $50 — snowballs into hundreds, eroding profits, trust, and compliance. According to the Association of Certified Fraud Examiners, businesses lose 5% of revenue annually to occupational fraud, much of it hiding in expense claims. That’s why strong expense fraud detection matters so much.

Moreover, when it goes unchecked, this stealthy abuse drains resources, undermines morale, and risks your reputation. In this post, you’ll discover how to identify red flags, implement proactive controls, and use CRMLeaf’s expense management tools to protect your organization— without slowing down reimbursements.

Why Expense Fraud Detection Is Vital

Expense fraud isn’t always grand theft — it often involves small, repetitive abuses:

- Tier-1 risks: personal items, duplicate receipts, mileage padding

- Tier-2 problems: inflated meals, fake vendors, altered dates

- Tier-3 threats: shell companies, per-diem tricks, ghost employees

Even small incidents add up. Consequently, these abuses:

- Shrink profit margins

- Drive up audit and compliance costs

- Damage credibility — especially in finance-driven sectors like real estate or consulting

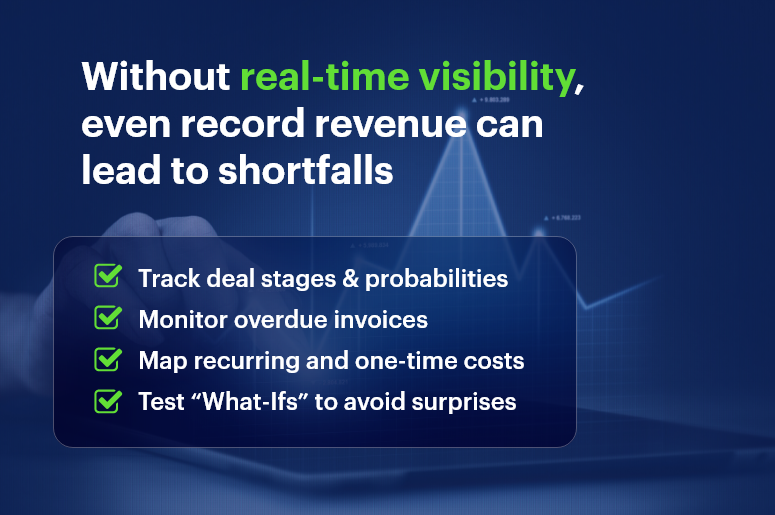

As companies grow, expense fraud detection becomes harder — especially when finance, HR, and accounting systems don’t connect. Hence, automated, data-driven fraud controls are essential. They reduce risk, preserve accountability, and ensure honest employees aren’t penalized by outdated, manual workflows.

That’s exactly where CRMLeaf’s CRM + ERP expense automation shines. It delivers real-time tracking, auto-flagging, and audit trails — allowing you to detect and prevent issues proactively.

Best Practices for Expense Fraud Detection (With CRMLeaf)

Here’s a smart, structured approach to detecting and preventing fraud early — paired with relevant ways CRMLeaf simplifies each step.

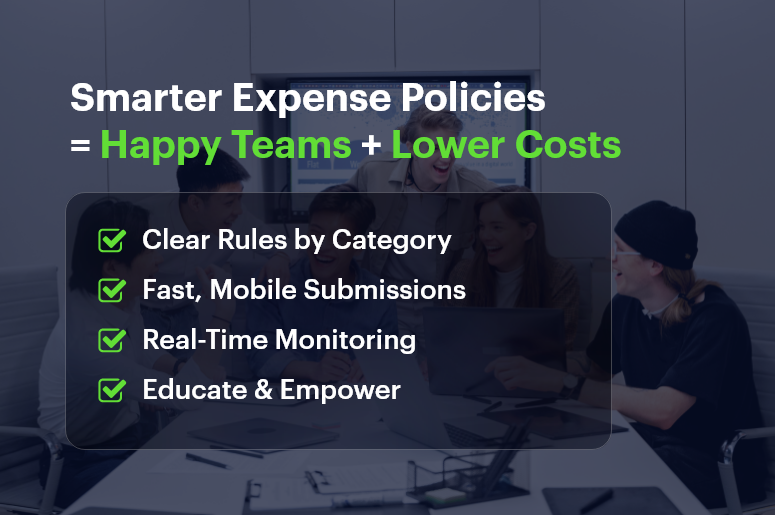

Establish Clear, Enforced Policies

- Define allowed expense categories, caps, and frequency rules (e.g., “$20 per meal”).

- Display policy guidance directly on submission forms so nobody “forgets.”

- CRMLeaf advantage: It embeds policies into the expense interface and auto-flags outliers at submission time, avoiding guesswork.

Automate Pre-Approval & Alerts

- Require sign-off for large or unusual expenses (flights, gift cards).

- Detects duplicate receipts, round-number patterns, or unknown vendors.

- CRMLeaf advantage: It automates pre-approval workflows and sends immediate manager alerts—no delays or manual oversight needed.

Monitor Patterns & Anomalies

- Use dashboards to spot unusual behavior (e.g., excessive mileage, frequent per-diems).

- Filter claims by vendor, employee, or category to find trends.

- CRMLeaf advantage: Its interactive reports let you drill into flagged claims instantly, surfacing inconsistencies fast.

Enforce Receipt and Data Completeness

- Require required fields like date, vendor, amount, purpose to be complete.

- Reject incomplete or vague submissions automatically.

- CRMLeaf advantage: The app makes fields mandatory and enforces data rules using conditional logic.

Implement Tiered Approvals & Escalations

- Auto-approve low-value claims, require lead sign-off for mid-range amounts, and escalate high-value items to finance heads.

- Delay or override triggers escalate alerts.

- CRMLeaf advantage: You can configure multi-level approval workflows and escalation triggers explicitly within ERP-linked workflows.

Conduct Periodic Audits & Sampling

- Run quarterly audits on random or flagged expense batches.

- Examine patterns like repeated receipts or round-number entries.

- CRMLeaf advantage: Audit logs automatically capture entire activity timelines, comments, and approvers — ideal for compliance.

Foster Training & Transparency

- Educate staff on approved expense types, common red flags, and how to comply.

- Encourage employees to consult policies when in doubt.

- CRMLeaf advantage: A built-in portal hosts expense policies, FAQs, and video tutorials—right where users work.

Customer Success Story: HorizonTech Solutions

HorizonTech — a high-growth consulting firm — noticed rising per-diem expenses, costing 2% in monthly overhead. After implementing CRMLeaf’s expense fraud detection, they:

- Set up auto flags for duplicate receipts and meal caps

- Required full receipts and mileage details

- Scheduled monthly audits

Within one quarter:

- Suspicious claims dropped by 75%

- Savings amounted to $20K

- Reimbursement times fell by 40%

As a result, their finance team now focuses on strategic budgeting, not chasing receipts. Employees enjoy faster, more transparent reimbursements, and policy compliance became effortless.

Key Takeaways: A Smart Expense Fraud Detection Strategy

Effective expense fraud detection isn’t about distrust — it’s about strong financial stewardship. To build a robust prevention system, follow these practical steps:

- Define clear, enforced expense policies

- Automate flags and pre-approvals

- Monitor submission patterns and anomalies

- Require full receipts and data integrity

- Enforce tiered approvals with escalation

- Run periodic audits

- Train employees and encourage policy clarity

When you combine these practices with CRMLeaf’s CRM + ERP expense automation, you get:

- Real-time monitoring

- Seamless policy enforcement

- Faster reimbursements

- Audit-ready workflows

You’ll minimize risk while keeping employees happy and financial controls strong.

FAQs

Q: What is expense fraud detection?

A: It’s the proactive detection and prevention of false or inflated expense claims using automation, policy enforcement, and data monitoring.

Q: Why is expense fraud detection important?

A: Because even small frauds can add up to significant losses, hamper budgets, and hurt trust across your organization.

Q: How does automation help prevent expense fraud?

A: Automation applies rules at submission time, flags anomalies immediately, routes approvals properly, and creates digital audit trails.

Q: Can small businesses use these practices?

A: Absolutely. Even small teams can benefit from structured expense policies and automated workflows—without needing large finance teams.

Q: How do I get started with CRMLeaf expense management?

A: Define expense categories and thresholds, set up workflow templates, and then pilot them in CRMLeaf to see real-time results.