Navigating payroll compliance is no longer just a back-office task — it’s a critical business responsibility that impacts employee trust, legal standing, and your bottom line. Whether you’re a startup or scaling enterprise, payroll compliance mistakes can cost you more than money — they can damage reputation, team morale, and operational efficiency.

In this guide, you’ll learn the must-know payroll laws, real-world scenarios, and how to stay compliant without draining time or resources. With help from platforms like CRMLeaf’s CRM + ERP, compliance becomes part of your workflow, not a fire drill.

Why Payroll Compliance Matters for Modern Businesses

Payroll compliance isn’t just about paying employees on time — it’s about doing it legally, accurately, and consistently. As your business grows, payroll gets more complex, and so do the risks.

Here’s why it matters:

- Avoid Costly Penalties: Missing tax deadlines or misclassifying employees can lead to thousands in fines and interest. Staying compliant protects your finances and keeps audits away.

- Maintain Employee Trust: Mistakes in paychecks — from incorrect deductions to late deposits — can erode employee satisfaction and increase churn.

- Meet Industry-Specific Requirements: From construction to tech to retail, every industry has different labor laws. Staying up-to-date keeps you compliant and competitive.

- Enable Better Growth Decisions: When your payroll data is accurate and compliant, you can plan for raises, new hires, and expansions with confidence.

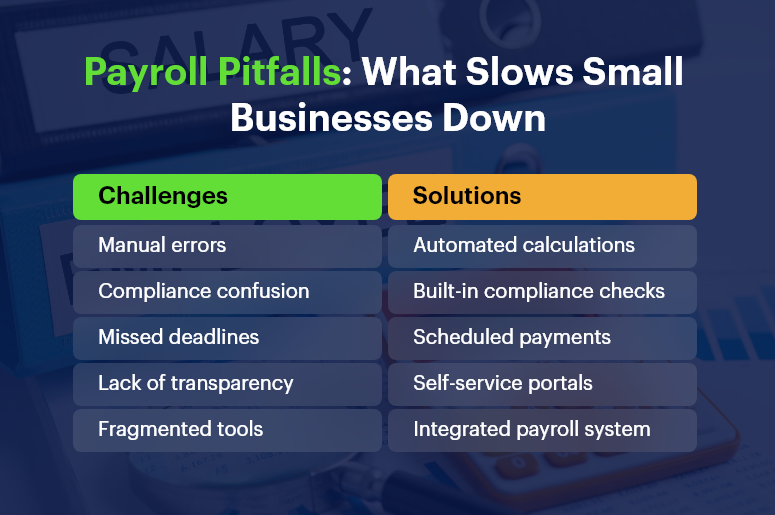

Common Payroll Compliance Challenges & How to Solve Them

1. Misclassifying Employees and Contractors

Improper classification affects taxes, benefits, and legal exposure. Classifying a contractor as a full-time employee (or vice versa) may trigger audits and legal consequences. Always verify roles with federal and state guidelines.

2. Inaccurate Tax Withholding and Reporting

Incorrect tax calculations can result in underpayment or overpayment. Businesses must stay current on IRS guidelines and local tax requirements. Automation through payroll compliance software reduces these risks.

3. Late or Missed Filings

Missing deadlines for payroll taxes, W-2s, or 1099s leads to penalties. Build a tax calendar, set automated reminders, or better yet — let your CRM + ERP do it for you.

4. Ignoring Wage and Hour Laws

From overtime rules to minimum wage updates, compliance means aligning your payment structure with ever-changing labor laws. Integrating legal updates into your payroll engine helps you stay alert.

5. Poor Recordkeeping

Federal law requires you to retain payroll records for several years. A centralized system ensures you don’t misplace vital documents during audits.

6. Failing to Provide Proper Pay Stubs

Employees have the right to transparent, itemized pay stubs. A payroll compliance checklist should include pay stub generation that complies with your jurisdiction.

7. Noncompliance with New Hire Reporting

Each state mandates reporting new hires within a specific time window. Ignoring this can result in steep fines. Automated systems ensure timely compliance.

8. Overlooking Multi-State Regulations

Operating in multiple states? You’ll face different wage laws, tax codes, and filing rules. A unified platform helps you customize compliance settings by location.

9. Failing to Keep Up with Tax Law Changes

Tax codes evolve constantly. Manual tracking invites errors. Instead, use a CRM + ERP system that integrates real-time tax law updates and reflects them in payroll.

10. Ignoring Employee Classification Updates

Employees move between roles or contract statuses. Keeping classifications updated ensures ongoing compliance. Make this part of your HR workflow.

Best Practices to Master Payroll Compliance

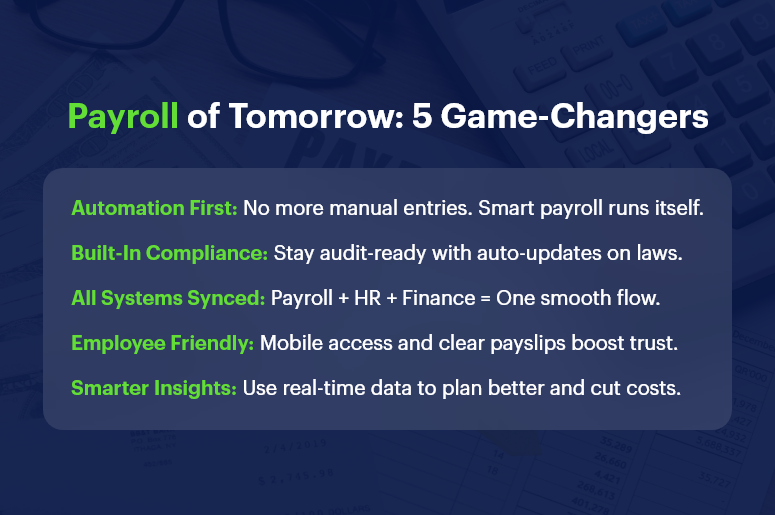

Automate Where Possible

Automated systems ensure accurate tax withholdings, filing deadlines, and paycheck calculations — freeing up HR for strategic work.

Create a Payroll Compliance Checklist

Outline your responsibilities, including reporting, documentation, audits, and tax deadlines. Review and update this list quarterly.

Audit Your Payroll Process Regularly

Set up periodic internal audits to identify errors early. Validate timesheets, benefits, classifications, and tax rates.

Stay Educated on Compliance Requirements

Subscribe to HR and legal newsletters. Join webinars. Platforms like the IRS and Department of Labor provide free, updated guidance.

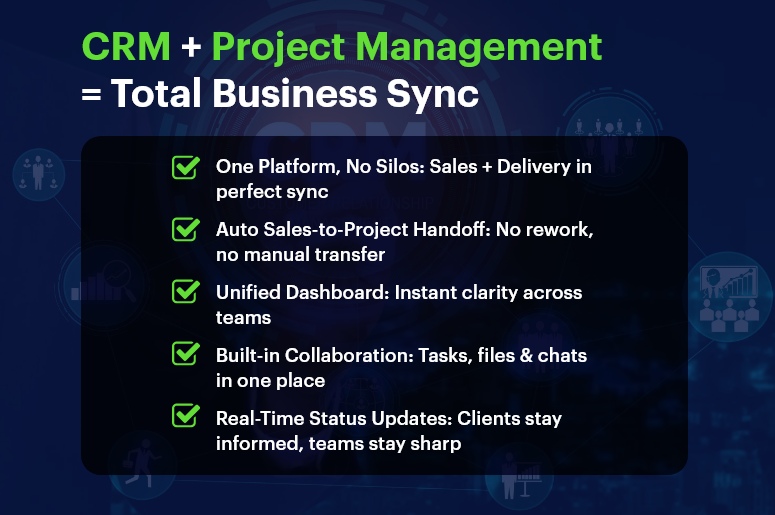

Work with Integrated Platforms

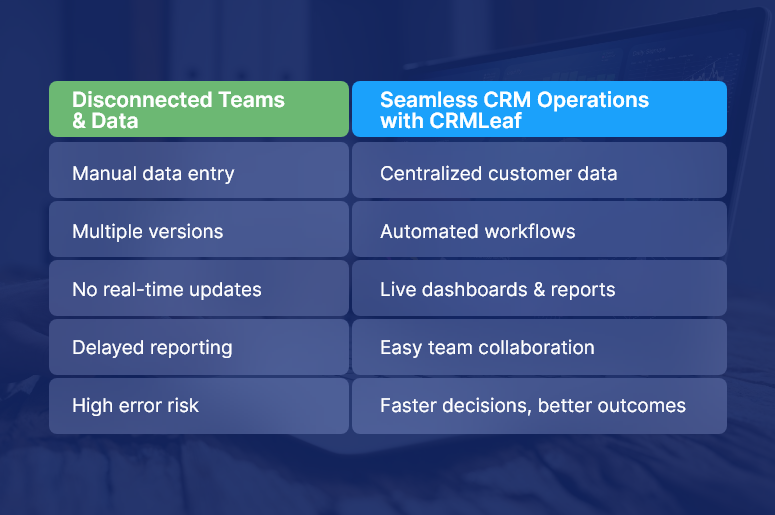

A disconnected spreadsheet can’t notify you of rule changes. Use CRMLeaf’s CRM + ERP to ensure HR, payroll, and compliance are all on the same page.

Keep Digital Records

Store pay stubs, tax filings, and employee contracts in a secure digital hub. Back them up and restrict access using role-based permissions.

Align HR and Payroll Teams

Regular syncs between HR and payroll ensure employee data — from bank accounts to benefits — remains accurate and compliant.

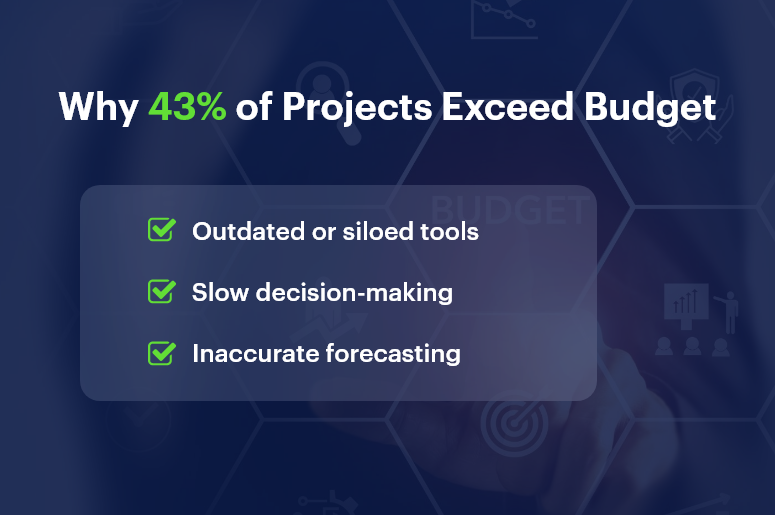

Customer Success Story

For example, SwiftHire Solutions, a mid-sized recruitment firm, used CRMLeaf’s automated payroll compliance features to eliminate filing errors and avoid $10,000+ in penalties over two years.

By centralizing HR, payroll, and employee data into one platform, they slashed admin time by 40% and stayed audit-ready during an IRS check. Their HR team can now focus on talent and engagement instead of tax forms.

Key Takeaways & Closing

Payroll compliance is critical to your legal, financial, and operational success. Mistakes are costly — both in money and morale.

Integrated tools like CRMLeaf’s CRM + ERP help automate, monitor, and update compliance processes, reducing errors and saving time.

Compliance isn’t a one-time job. You need a system that evolves with laws and your business.

What to do next:

- Audit your current payroll workflow. Identify risks, gaps, or outdated processes.

- Create a compliance checklist. Use it monthly.

- Book a demo of CRMLeaf to see automation in action.